by Prince Licaylicay | Jun 11, 2020 | All Articles, Buying, Investing

Let’s examine what a cap rate is and how it allows investors to evaluate their rate of return. There are many ways to value real estate. It consists of appraising the land and building, comparing comparable properties, or calculating the value based on the rents being generated.

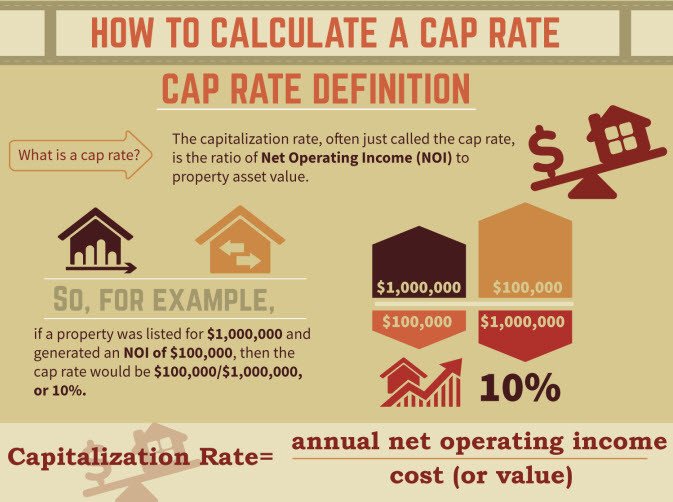

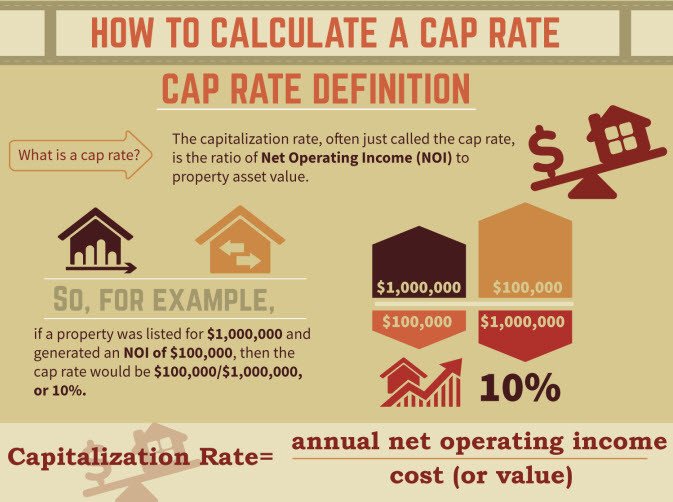

The later method is where the capitalization rate (or “cap rate”) comes into play. The cap rate (expressed as the ratio of the property’s net income to its purchase price) allows investors to compare properties by evaluating a rate of return on the investment made in the property. By examining the actual income (or rent) that the property generates and then deducting operating expenses (not including debt costs), the investor arrives at a property-level net operating income (or NOI). Once you determine the NOI, you simply divide that by the cost of the property or the price you are buying or selling the subject building for.

Calculating Cap Rate

While this method of valuation may appear simple, the use of the tool can be extremely valuable. Also, it’s important to mention that a Cap Rate does not show the full picture of the investment. It’s a only a snapshot of the first year’s returns and should not be treated as the only factor to consider. In general, a lower cap rate indicates there is less risk associated with the investment (due to a stronger tenant, such as a national chain or increased demand) and a higher cap rates can be associated with higher risk alternatives.

Real estate investors rely upon a variety of types information when negotiating for income producing properties – for instance, the desirability of the property’s current location and/or any prospective changes in the neighborhood are two common factors.

Looking for more information on cap rates? Click HERE to be forwarded to a Wiki How article with great simple diagrams – enjoy.

Investing In Commercial Real Estate?

Even after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.

Need help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!

Phill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns.

Bookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCRE

by Phill Tomlinson | Jun 4, 2020 | Blog

Your commercial property won’t sell, you listed your building up for sale and it simply didn’t sell. The first thing to do is to take a step back and analyze the situation. Try to assess what factors led to your property not selling. Below are the top four reasons why properties tend to languish on the market n

Commercial Property Won’t Sell? Consider These Factors

n(1) Is My Commercial Property Overpriced?nnOverpricing your property is usually the number one reason it did not sell. The price of your property should be competitively priced with other buildings in your area which have similar features. Your real estate broker will help you establish the best price based on the competition.nnPrice reductions can be an issue in the pricing game. Many owners set an asking price above the market with the idea they will reduce the price as time goes on. However, doing this can mean being passed over by real buyers who end up purchasing comparable properties as the right price. By the time you reduce the price to where it should be, you & rsquo;ve lost access to the first round of buyers. You can counter this by making your price reduction extremely competitive.nnProperly pricing your property is as much an art as a skill and your commercial real estate broker will help you assess the competition and help you establish an asking price that will get the property sold.nn nn(2) What is the Condition of the PropertynnAll of the cosmetic things, such as paint, landscaping, window coverings and flooring should be in good shape and the building should be spotless inside and out. It’s amazing how most buyers refuse to see through superficial, cosmetic shortcomings. And making these cosmetic improvements is relatively inexpensive. To get the building sold, make a small investment in landscaping. Make sure the lawn is in good shape and trees and shrubs neat and trimmed. Make sure walkways are clear. If you don’t have the time to do it, pay someone.nnExterior Make sure there is no chipping paint, dirty windows, or clutter. Most importantly, remember that most buyers will notice the condition of the front door when they walk in.nInterior Make sure the carpets are clean and attractive, the walls painted (if it needs it) and clean (no smudges.), the break room clutter-free and the windows are spotless. Also, remove excess furniture since excess furniture makes rooms appear much smaller. Make sure all clutter is off the floor and organized. And finally, make sure the smell of the building is appealing.nn nn(3) Was Your Property Aggressively Marketed?nnAnother primary reason your commercial property won’t sell is a simple lack of exposure. In a very hot market, a listing in services like CoStar/LoopNet alone should generate an adequate number of buyers. However, if your market is anything less than red-hot, your building needs aggressive marketing.nnMany buyers work with a commercial real estate broker. Your broker will make sure your property is exposed to the active buyer & rsquo;s brokers in your area through listing services, emails, phone calls and open houses. Also, most active brokers have a strong network of other brokers and buyers and can introduce your property directly.nn nn(4) Did You Hire The Right Commercial Real Estate Agent? nnLike any profession, there are very effective and ineffective commercial real estate brokers. Many commercial real estate brokers work hard and employ strong marketing techniques. They have a strong network and access to buyers. Many work hard to get your building sold. However, many do not. Did your broker simply place the building in CoStar/LoopNet/Xceligent? Or, did she or he inform their network of buyers about your property? How about presenting your property at sales meetings both at her or his office and other company offices? Did she or he promote your property with email announcements, brochures, banners, and signage to showcase your property?nnAsk yourself, was your broker passionate about selling your property? If not, now is the time to find the broker who will get your building sold.nn

nn

Investing In Commercial Real Estate?

nEven after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.nn nnNeed help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!n nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCREnn nn

nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCREnn nn

by Prince Licaylicay | Jun 4, 2020 | All Articles, Selling

Your commercial property won’t sell, you listed your building up for sale and it simply didn’t sell. The first thing to do is to take a step back and analyze the situation. Try to assess what factors led to your property not selling. Below are the top four reasons why properties tend to languish on the market

Commercial Property Won’t Sell? Consider These Factors

(1) Is My Commercial Property Overpriced?

Overpricing your property is usually the number one reason it did not sell. The price of your property should be competitively priced with other buildings in your area which have similar features. Your real estate broker will help you establish the best price based on the competition.

Price reductions can be an issue in the pricing game. Many owners set an asking price above the market with the idea they will reduce the price as time goes on. However, doing this can mean being passed over by real buyers who end up purchasing comparable properties as the right price. By the time you reduce the price to where it should be, you & rsquo;ve lost access to the first round of buyers. You can counter this by making your price reduction extremely competitive.

Properly pricing your property is as much an art as a skill and your commercial real estate broker will help you assess the competition and help you establish an asking price that will get the property sold.

(2) What is the Condition of the Property

All of the cosmetic things, such as paint, landscaping, window coverings and flooring should be in good shape and the building should be spotless inside and out. It’s amazing how most buyers refuse to see through superficial, cosmetic shortcomings. And making these cosmetic improvements is relatively inexpensive. To get the building sold, make a small investment in landscaping. Make sure the lawn is in good shape and trees and shrubs neat and trimmed. Make sure walkways are clear. If you don’t have the time to do it, pay someone.

Exterior Make sure there is no chipping paint, dirty windows, or clutter. Most importantly, remember that most buyers will notice the condition of the front door when they walk in.

Interior Make sure the carpets are clean and attractive, the walls painted (if it needs it) and clean (no smudges.), the break room clutter-free and the windows are spotless. Also, remove excess furniture since excess furniture makes rooms appear much smaller. Make sure all clutter is off the floor and organized. And finally, make sure the smell of the building is appealing.

(3) Was Your Property Aggressively Marketed?

Another primary reason your commercial property won’t sell is a simple lack of exposure. In a very hot market, a listing in services like CoStar/LoopNet alone should generate an adequate number of buyers. However, if your market is anything less than red-hot, your building needs aggressive marketing.

Many buyers work with a commercial real estate broker. Your broker will make sure your property is exposed to the active buyer & rsquo;s brokers in your area through listing services, emails, phone calls and open houses. Also, most active brokers have a strong network of other brokers and buyers and can introduce your property directly.

(4) Did You Hire The Right Commercial Real Estate Agent?

Like any profession, there are very effective and ineffective commercial real estate brokers. Many commercial real estate brokers work hard and employ strong marketing techniques. They have a strong network and access to buyers. Many work hard to get your building sold. However, many do not. Did your broker simply place the building in CoStar/LoopNet/Xceligent? Or, did she or he inform their network of buyers about your property? How about presenting your property at sales meetings both at her or his office and other company offices? Did she or he promote your property with email announcements, brochures, banners, and signage to showcase your property?

Ask yourself, was your broker passionate about selling your property? If not, now is the time to find the broker who will get your building sold.

Investing In Commercial Real Estate?

Even after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.

Need help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!

Phill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns.

Bookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCRE

![]()

Recent Comments