by Phill Tomlinson | Jun 25, 2020 | Blog

A commercial lease agreement can be an intimidating document, especially for those who don’t work with real estate on a regular basis. Reading your entire lease carefully is vital to ensuring that you’re getting the best deal when you’re renting commercial office space; however, some terms and clauses are of particular importance and should be considered with the utmost of care.n

6 terms to look for in a commercial lease agreement

n

Rent and Common Area Maintenance

nThe last thing you want is to end up with is a surprise when it comes time to make your first month’s rent payment. Take the time to carefully read the rent terms. Are there any fees in addition to your rent? When is the rent due and how must it be paid? What are the penalties for late payments? How much is the common area maintenance and what specifically does it cover? Consider all of this plus what isn’t included in your lease before you sign.n

Right of First Refusal

nWhen you find the perfect office space, you want to make sure that you have the chance to stay there when your lease is up. The right of first refusal clause says that your landlord must give you a chance to say that you don’t want to renew your lease before they make the property available to other prospective tenants.n

Definition of the Premises

nThis part of your lease tells you exactly what you’re renting. Make sure that the entire office space’s square footage is correctly stated in the lease. If the landlord promised you use of shared facilities, such as restrooms in a corridor, a shared reception area or a shared break room or cafeteria, these spaces should also be mentioned here. Don’t leave anything as a mere promise. Make sure it’s spelled out in writing under the definition of the premises.n

Subleasing and Assignment

nIf your business needs change and you no longer need all or part of your office space, this clause gives you the ability to sublease your space or assign it to another tenant to reduce your monthly costs. The future is unpredictable, so it’s worth it to fight to have liberal subleasing and assignment rights included in the language.n

Use and Exclusives Clause

nDoes the lease have any stipulations on what kind of businesses can hold office space in the building? If so, is there any possibility that the defined acceptable uses may limit your future endeavors? You don’t want to find yourself unable to expand into a new field, niche or industry due to your restrictive lease. On the flip side, is there any language that protects you from having a competitor move in across the call? Depending on your line of business, an exclusives clause may be necessary to protect your interests.n

Maintenance Clause

nWhat happens when something goes wrong with your office space? Who is responsible for handling the cost of the maintenance and who is required to make arrangements to have repairs or maintenance done? Make sure the responsibilities are clearly defined to save yourself future headachesnn

nn

Investing In Commercial Real Estate?

nEven after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.nn nnNeed help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of! nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/philltomlinson. #LeveragedCREnn

nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/philltomlinson. #LeveragedCREnn

by Prince Licaylicay | Jun 25, 2020 | All Articles, Leasing

A commercial lease agreement can be an intimidating document, especially for those who don’t work with real estate on a regular basis. Reading your entire lease carefully is vital to ensuring that you’re getting the best deal when you’re renting commercial office space; however, some terms and clauses are of particular importance and should be considered with the utmost of care.

6 terms to look for in a commercial lease agreement

Rent and Common Area Maintenance

The last thing you want is to end up with is a surprise when it comes time to make your first month’s rent payment. Take the time to carefully read the rent terms. Are there any fees in addition to your rent? When is the rent due and how must it be paid? What are the penalties for late payments? How much is the common area maintenance and what specifically does it cover? Consider all of this plus what isn’t included in your lease before you sign.

Right of First Refusal

When you find the perfect office space, you want to make sure that you have the chance to stay there when your lease is up. The right of first refusal clause says that your landlord must give you a chance to say that you don’t want to renew your lease before they make the property available to other prospective tenants.

Definition of the Premises

This part of your lease tells you exactly what you’re renting. Make sure that the entire office space’s square footage is correctly stated in the lease. If the landlord promised you use of shared facilities, such as restrooms in a corridor, a shared reception area or a shared break room or cafeteria, these spaces should also be mentioned here. Don’t leave anything as a mere promise. Make sure it’s spelled out in writing under the definition of the premises.

Subleasing and Assignment

If your business needs change and you no longer need all or part of your office space, this clause gives you the ability to sublease your space or assign it to another tenant to reduce your monthly costs. The future is unpredictable, so it’s worth it to fight to have liberal subleasing and assignment rights included in the language.

Use and Exclusives Clause

Does the lease have any stipulations on what kind of businesses can hold office space in the building? If so, is there any possibility that the defined acceptable uses may limit your future endeavors? You don’t want to find yourself unable to expand into a new field, niche or industry due to your restrictive lease. On the flip side, is there any language that protects you from having a competitor move in across the call? Depending on your line of business, an exclusives clause may be necessary to protect your interests.

Maintenance Clause

What happens when something goes wrong with your office space? Who is responsible for handling the cost of the maintenance and who is required to make arrangements to have repairs or maintenance done? Make sure the responsibilities are clearly defined to save yourself future headaches

Investing In Commercial Real Estate?

Even after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.

Need help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!

Phill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns.

Bookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/philltomlinson. #LeveragedCRE

by Phill Tomlinson | Jun 18, 2020 | Blog

Planning tenant improvement projects used to be simple — design rows of private offices with cubicles in front and don’t forget a storage room and reception area. Modern offices are much more variable. While the key to a successful project is to customize it extensively to your needs, there are still a few rules of thumb that can make any project better.n

5 Tips to Planning Tenant Improvement Projects

nDon’t Forget the WiresnnYour users have spoken, and they love wireless devices. However, the more wireless devices that you have, the more you bump up against two basic problems:n n1. Wireless devices need wires for power.n n2. Wireless spectrum for both wi-fi and cellular data is limited.n nThe solution to these problems is easy. Provide as many traditional connections as you can. Power outlets allow your workers to stay juiced up, and adding traditional network wiring back into your tenant improvement projects can solve the bandwidth problem. While not every device will get plugged in, giving fat data pipes to shared equipment like printers, scanners and servers and to power users who have significant network utilization will make those devices work better. It’ll also also keep them off of the wireless network, conserving bandwidth for others.n nRecycle When PossiblennMany companies try to do their tenant improvement projects in a green fashion. However, many recycled materials cost the same or more than newly manufactured projects. If you’d like to go green and save green, reuse what is already in the space. Ceiling tiles, modern lighting fixtures, doors and the like from the previous tenant are frequently in good enough shape to be reused, saving you from both paying for removal and from purchasing new materials.n nBe Open to Being ClosednnLike many companies, you probably are considering an open floor plan build-out. An open tenant improvement plan is more flexible, less expensive to build and can bring productivity benefits. However, while you might want to keep your workspaces flexible and open, don’t forget to create defined spaces that will help make your workplace yours. This could include small meeting rooms, in-suite cafes, or any other closed areas that can both define spaces and define the groups that are using them.n nLeverage LED LightingnnAdvances LED lighting fixtures have two obvious benefits — they consume less power than other technologies and they are longer lasting, necessitating less maintenance over time. However, the newest LED bulbs have an additional benefit — the ability to change colors. Studies are starting to show that fixtures that mimic the shifting color of natural light over the course of the day have positive impacts on both employee health and productivity.n nLook Up…. Once.nnIn a tenant improvement project, even a few dollars per square foot can make a difference. One way to save money and create cooler, more flexible space is to eliminate the traditional acoustic tile ceiling. Open ceiling offices aren’t just industrial-chic, though. The higher space feels larger, while the open space means that your maintenance team has one less thing to clean while having easier access to lighting, HVAC and wiring systems that run along the ceiling for repairs and retrofits.nn

nn

Investing In Commercial Real Estate?

nEven after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.nn nnNeed help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!n nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCREnn nn

nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCREnn nn

by Prince Licaylicay | Jun 18, 2020 | All Articles, Investing

Planning tenant improvement projects used to be simple — design rows of private offices with cubicles in front and don’t forget a storage room and reception area. Modern offices are much more variable. While the key to a successful project is to customize it extensively to your needs, there are still a few rules of thumb that can make any project better.

5 Tips to Planning Tenant Improvement Projects

Don’t Forget the Wires

Your users have spoken, and they love wireless devices. However, the more wireless devices that you have, the more you bump up against two basic problems:

1. Wireless devices need wires for power.

2. Wireless spectrum for both wi-fi and cellular data is limited.

The solution to these problems is easy. Provide as many traditional connections as you can. Power outlets allow your workers to stay juiced up, and adding traditional network wiring back into your tenant improvement projects can solve the bandwidth problem. While not every device will get plugged in, giving fat data pipes to shared equipment like printers, scanners and servers and to power users who have significant network utilization will make those devices work better. It’ll also also keep them off of the wireless network, conserving bandwidth for others.

Recycle When Possible

Many companies try to do their tenant improvement projects in a green fashion. However, many recycled materials cost the same or more than newly manufactured projects. If you’d like to go green and save green, reuse what is already in the space. Ceiling tiles, modern lighting fixtures, doors and the like from the previous tenant are frequently in good enough shape to be reused, saving you from both paying for removal and from purchasing new materials.

Be Open to Being Closed

Like many companies, you probably are considering an open floor plan build-out. An open tenant improvement plan is more flexible, less expensive to build and can bring productivity benefits. However, while you might want to keep your workspaces flexible and open, don’t forget to create defined spaces that will help make your workplace yours. This could include small meeting rooms, in-suite cafes, or any other closed areas that can both define spaces and define the groups that are using them.

Leverage LED Lighting

Advances LED lighting fixtures have two obvious benefits — they consume less power than other technologies and they are longer lasting, necessitating less maintenance over time. However, the newest LED bulbs have an additional benefit — the ability to change colors. Studies are starting to show that fixtures that mimic the shifting color of natural light over the course of the day have positive impacts on both employee health and productivity.

Look Up…. Once.

In a tenant improvement project, even a few dollars per square foot can make a difference. One way to save money and create cooler, more flexible space is to eliminate the traditional acoustic tile ceiling. Open ceiling offices aren’t just industrial-chic, though. The higher space feels larger, while the open space means that your maintenance team has one less thing to clean while having easier access to lighting, HVAC and wiring systems that run along the ceiling for repairs and retrofits.

Investing In Commercial Real Estate?

Even after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.

Need help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!

Phill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns.

Bookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCRE

by Phill Tomlinson | Jun 11, 2020 | Blog

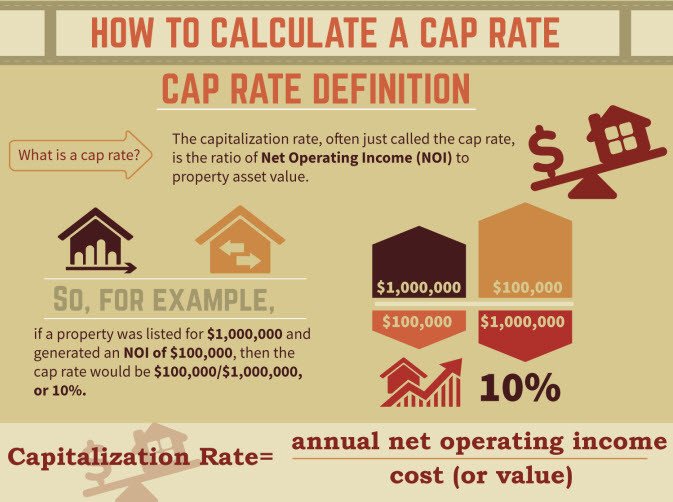

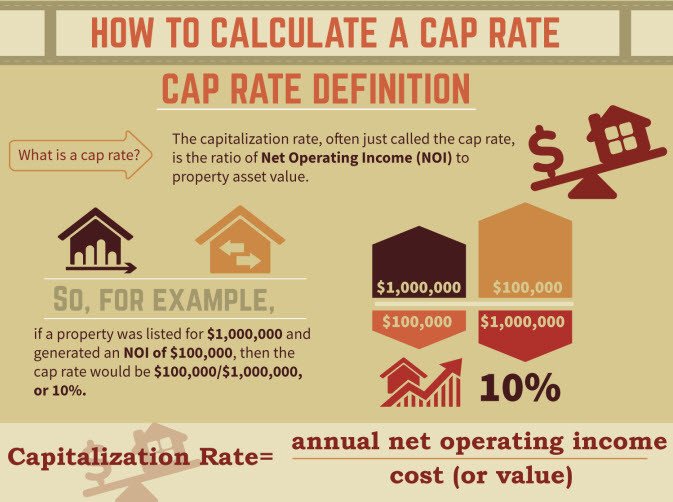

Let’s examine what a cap rate is and how it allows investors to evaluate their rate of return. There are many ways to value real estate. It consists of appraising the land and building, comparing comparable properties, or calculating the value based on the rents being generated.nnThe later method is where the capitalization rate (or “cap rate”) comes into play. The cap rate (expressed as the ratio of the property’s net income to its purchase price) allows investors to compare properties by evaluating a rate of return on the investment made in the property. By examining the actual income (or rent) that the property generates and then deducting operating expenses (not including debt costs), the investor arrives at a property-level net operating income (or NOI). Once you determine the NOI, you simply divide that by the cost of the property or the price you are buying or selling the subject building for.n

Calculating Cap Rate

n nnWhile this method of valuation may appear simple, the use of the tool can be extremely valuable. Also, it’s important to mention that a Cap Rate does not show the full picture of the investment. It’s a only a snapshot of the first year’s returns and should not be treated as the only factor to consider. In general, a lower cap rate indicates there is less risk associated with the investment (due to a stronger tenant, such as a national chain or increased demand) and a higher cap rates can be associated with higher risk alternatives.nnReal estate investors rely upon a variety of types information when negotiating for income producing properties – for instance, the desirability of the property’s current location and/or any prospective changes in the neighborhood are two common factors.nnLooking for more information on cap rates? Click HERE to be forwarded to a Wiki How article with great simple diagrams – enjoy. nn

nnWhile this method of valuation may appear simple, the use of the tool can be extremely valuable. Also, it’s important to mention that a Cap Rate does not show the full picture of the investment. It’s a only a snapshot of the first year’s returns and should not be treated as the only factor to consider. In general, a lower cap rate indicates there is less risk associated with the investment (due to a stronger tenant, such as a national chain or increased demand) and a higher cap rates can be associated with higher risk alternatives.nnReal estate investors rely upon a variety of types information when negotiating for income producing properties – for instance, the desirability of the property’s current location and/or any prospective changes in the neighborhood are two common factors.nnLooking for more information on cap rates? Click HERE to be forwarded to a Wiki How article with great simple diagrams – enjoy. nn

nn

Investing In Commercial Real Estate?

nEven after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.nn nnNeed help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!n nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCREnn nn

nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCREnn nn

![]() nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/philltomlinson. #LeveragedCREnn

nn nnPhill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns. nn nnBookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/philltomlinson. #LeveragedCREnn

nnWhile this method of valuation may appear simple, the use of the tool can be extremely valuable. Also, it’s important to mention that a Cap Rate does not show the full picture of the investment. It’s a only a snapshot of the first year’s returns and should not be treated as the only factor to consider. In general, a lower cap rate indicates there is less risk associated with the investment (due to a stronger tenant, such as a national chain or increased demand) and a higher cap rates can be associated with higher risk alternatives.nnReal estate investors rely upon a variety of types information when negotiating for income producing properties – for instance, the desirability of the property’s current location and/or any prospective changes in the neighborhood are two common factors.nnLooking for more information on cap rates? Click

nnWhile this method of valuation may appear simple, the use of the tool can be extremely valuable. Also, it’s important to mention that a Cap Rate does not show the full picture of the investment. It’s a only a snapshot of the first year’s returns and should not be treated as the only factor to consider. In general, a lower cap rate indicates there is less risk associated with the investment (due to a stronger tenant, such as a national chain or increased demand) and a higher cap rates can be associated with higher risk alternatives.nnReal estate investors rely upon a variety of types information when negotiating for income producing properties – for instance, the desirability of the property’s current location and/or any prospective changes in the neighborhood are two common factors.nnLooking for more information on cap rates? Click

Recent Comments